Read More

How taxing is your options trade?

Index and ETF Options both offer broad market exposure to execute trading strategies, however they're not treated the same at tax time.

f you're an active trader, you work hard to generate profits in your trading account. You study the charts, you watch the day's headlines, and research your entry and exit points before placing an order. If things go your way, you end up with a winning trade in your account. But if you're using a broad-market ETF to trade options on the S&P 500®, you may be paying more in taxes than you would by using index options.* That means you may be giving up more of your hard-earned trading profits.

Many traders use a variety of ETF options products, such as SPY, to gain exposure to the S&P 500. What they may not realize is that capital gains from ETF options may be considered short-term gains and taxed at the ordinary income rate, which in 2019 ranged from 10-37%. Depending on individual trading and your tax bracket, that could be a big hit to your income.

In a rush? Watch the video to learn more about the different tax treatments of ETF and index options.

Index Options may be Eligible for 60/40 Tax Treatment

Many S&P 500 index options—including Mini-SPX, which has the same notional size as SPY options and goes by the ticker XSPSM—may be eligible for more favorable tax treatment. Under section 1256 of the Tax Code, certain exchange-traded options, including XSP, may qualify for 60% long term/40% short-term rates, even if the option is held for less than a year. With 2019 long-term capital gains rates ranging from 0-20% versus short-term capital gains rates of 10-37%, Mini-SPX options may allow you to keep more of your trading profits.

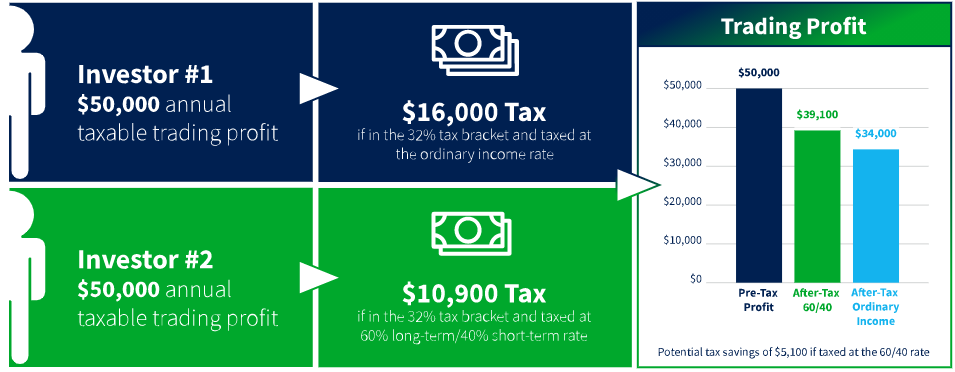

Take, for example, an investor in the 32% tax bracket who had $50,000 in taxable trading profits. If they were trading ETF options, they could be taxed at the ordinary income rate and pay as much as $16,000 in taxes. If, on the other hand, the investor was trading index options that qualified for 60%/40% tax treatment, they would only pay $10,900. That's a difference of $5,100. Ask your accountant about the tax implications of trading ETF options versus index options.

Potential Tax Savings with Index Options

In addition to the potentially different tax treatment, there are several other important differences between ETF options and index options. If you're an options seller, you'll particularly want to understand the differences between European and American style options and the implications of early assignment.